With the scale of online shopping being primarily dominant in the urban areas of China and with a growing concern that consumer spending has plateaued in recent months, Alibaba and JD.com have each been investing in their logistics units to make deliveries possible in a number of countryside villages.

Pressure from shareholders who are concerned about the growth of both Alibaba and JD.com has prompted both giants to take on the challenge of reaching out to the rural market for additional online e-commerce trade.

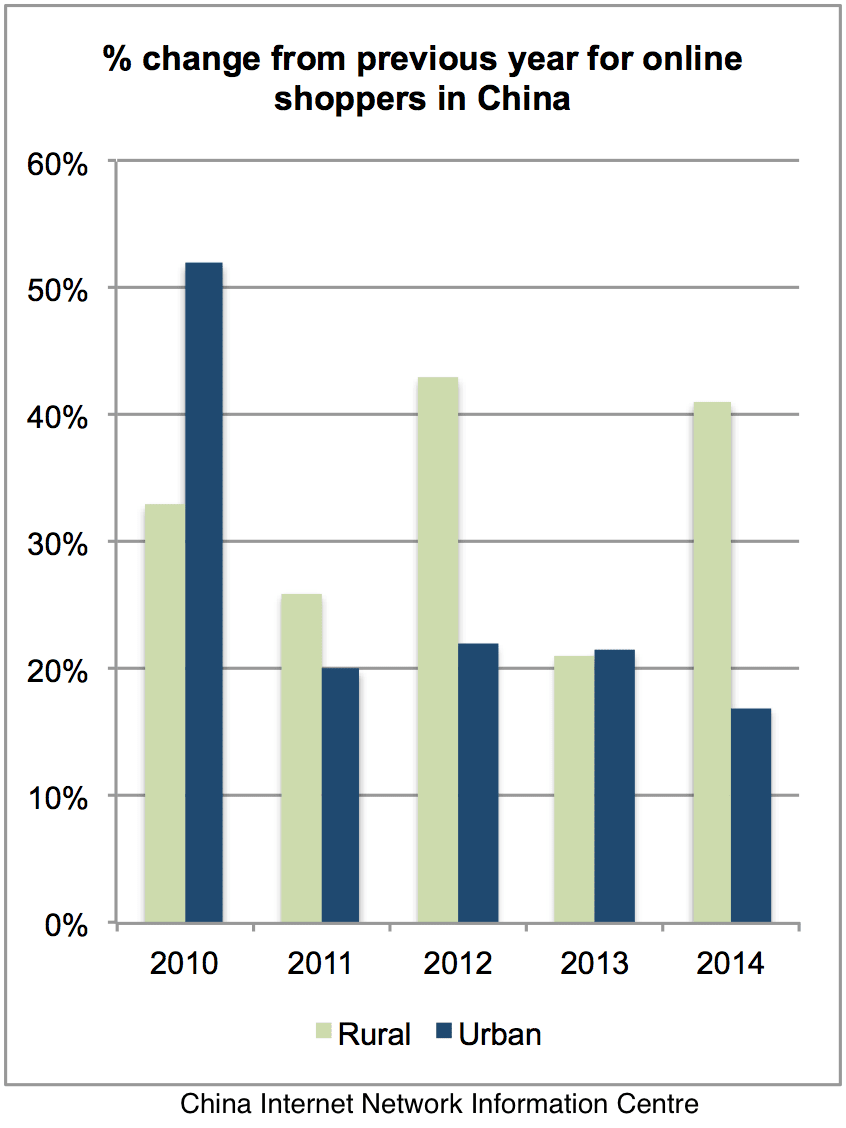

There are approximately 600 million rural citizens in China with a growing per-capita annual income. According to a government research group China Internet Network Information Centre (CINIC), 77 million rural living Chinese citizens shopped online which equates to a 41% increase on the previous year compared with 17% growth in urban areas. This market could potentially provide increased sales revenues for both companies over the coming years.

Over the next three to five years, Alibaba will be investing RMB 10 billion in order to build 1,000 county-level distribution centres along with 100,000 village drop-off points which would allow Alibaba reach a vast amount of Chinese consumers across the country. Drop-off stations will be highlighted in bright orange and green with the phrase ‘Rural Taobao’ indicated on the sign so that customers can easily identify.

Further, while the rural consumer economy grows and the adoption of smartphones increases, we will see additional growth in the volume of goods purchased online through Taobao, Tmall and JD.com.

With both Alibaba and JD.com making considerable efforts to grow their e-commerce businesses in the rural parts of China, it is likely that this would provide long-term growth. However, both giants are expected to have exposure to only a fraction of the villages in China. Additional growth strategies would need to be considered by both companies moving forward.