Displaying items by tag: capital markets

Future of the rising government debt in China

Last month, Shanghai Chaori Solar Energy Science & Technology became the first company to default in China's bond market when it failed to make a full payment on the issued debt. This shows that the Chinese state is not going to back up even big private borrowers. Several other companies are also on the verge of debt insolvency, according to local media sources, with government debt also on the rise.

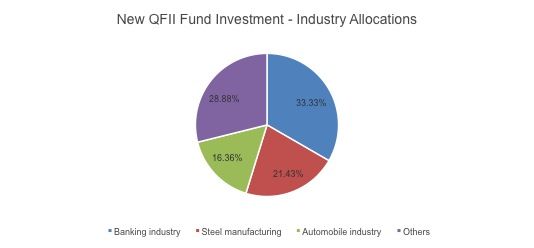

The latest statistics about the A-share markets illustrate the main industries that QFII funds invested at the end of 2013, according to data from 1334 listed firms’ 2013 annual reports. The banking industry is the most attractive industry for QFII investors, taking about 1/3 of the total new shareholding volume with the steel industry and automobile industry ranked the 2nd and the 3rd.

The banking industry makes sense because of the relatively low valuations. The steel industry is currently suffering in China, so QFIIs likely have confidence that Chinese urbanization and development of automobile industry will continue. For automobile industry, as Chinese government intends to push hardly on new energy vehicles especially electricity-powered vehicles, could pose an interesting QFII investment allocaction.

Does the High Frequency Trading debate matter for China?

High frequency trading (HFT) has roughly been in existence since 1999 in the US as execution times have shortened from several seconds to millisecond or even microseconds due to advanced trading technologies and a general demand for increased speed. Figures from August 2013 showed that in the global FX market, HFT took approximately 40% of the total trading volume, within which, almost half of the volume happened in the spot market. For the global futures market, HFT volume represents about 40% of the total volume. In the equities market in the US, HFT volume took approximately 73% of all equity order volume. Typical strategies executed by HFT traders are trading ahead of index fund rebalancing, market making, ticker tape trading, event arbitrage, statistical arbitrage, news-based trading and low-latency strategies.

You'd be forgiven for missing it, but in the buying spree that we've seen in the last couple of weeks from Alibaba, one of the most significant investments was for a controlling stake in Hundsun Technologies. The ~US$532M investment in the firm means that Alibaba now has control of nearly 95% of all domestic trading systems in China and continues to consolidate its position as a financial technology provider.

Special 'Bad Loan Development Zone' in the Yangtze?

Once known for its economic development zone, the rich Yangtze river delta now has become a hotbed for something else: non-performing loans.

What role does InTime play in Alibaba's 2020 strategy?

A couple of days ago, media announced that Alibaba had made a substantial investment in InTime, which is a Hong Kong company that manages mainland China upper-end retail malls. These malls are typically branded InTime, but are multi-brand inside where each brand has a small section and potentially dedicated staff to that section.

RMB/USD spot fluctuation range increase to ±2%

On March 15, 2014, the PBOC announced that the daily RMB/USD exchange rate float range in the Chinese interbank market would increase to ±2%, which will be implemented on March 17. The chart below shows the expansion of fluctuation range for RMB/USD spot, which is meaningful to Chinese FX market.

Analysts from Kapronasia believe that it is an important step towards fully internationalization of RMB. The data below also illustrate that Chinese government is accelerating the process of internationalization of RMB. We are looking forward to further FX market reform, in the Shanghai Pilot Free Trade Zone, or in the whole country in 2014.

Shanghai Free Trade Zones showing signs of payment activity

After what seems like forever, on February 18th, the regulators gave us a milestone reform for cross-border trade.

Opening the door for hedge funds in China

Hongkou is a geographic district in Shanghai, on the west side of the Huangpu River, north of the center of Shanghai and close to Pudong District. The Hongkou Hedge Fund Park was officially established on Oct. 18, 2013, as the first test-bed specifically for developing local hedge fund industry and introducing foreign hedge funds in China. Through market reforms and special incentives, the Hongkou government hopes to make the Hedge Fund Park a key part of Shanghai, and indeed China’s, hedge fund industry.

The Impact on China of the U.S. Government Shutdown

The U.S. Government Shutdown and Its Impact

The shutdown of the U.S. government ended as the two U.S. political came to an agreement to delay the decision to January-February of 2014. This means that the global market instability will likely still be on-going until the beginning of next year. This also means that the U.S. market may not be as lucrative and attractive as before, as critical decisions regarding the debt ceiling and government funding are still not solved.

It is important to figure out the impacts of the incident on Chinese economy, as the U.S. and China are the world’s number 1 and 2 economies with strong ties. The index trends in East Asia, oil consumptions and imports by China, and geo-political status of China are all important aspects to consider to understand the impact.

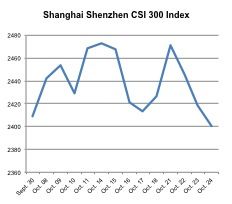

Market Change after the End of Shutdown

The Chinese stock index fell right after the announcement of the end of the government shutdown, while other East Asian and Southeast Asian market indexes rose. Although, it is hasty to conclude that China had served as a ‘refugee market’ or as an alternative to the U.S. market just from that factor, one could draw certain implications that people were shifting their investments in and out of the US / China as a the appeal of each market shifted.

U.S. – China Relations from multiple angles

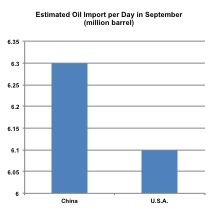

According to the U.S. Energy Information Administration’s latest report, China surpassed the U.S. in terms of oil imports in September, due to oil consumption surpassing production. Part of the reason behind this is that the U.S. has been decreasing the total import of crude oil – China is replacing the U.S. demand. If this trend continues, and the decrease of oil price also continues, China will benefit from the outcome by stabilizing the export production cost, but at the same time become more susceptible to the oil price. The economic ties with the U.S. has to be a factor here, as crude oil imports to China are used for the refined oil products and the production of manufacturing goods that go to other nations around the world. Since the U.S. is the biggest individual nation in terms of absorbing Chinese exports, the susceptibility will only be counterbalanced when Chinese exports are sold with minimum hindrance.

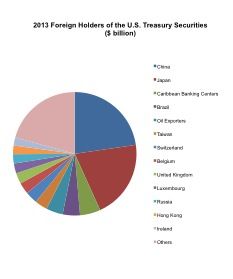

The ultimate factor, however, is the sovereign debt of the U.S. held by China. In 2011 China already became the top

The ultimate factor, however, is the sovereign debt of the U.S. held by China. In 2011 China already became the top  U.S. government debt holder, accounting for the 8 percent of total U.S. public debt. Even in percentage terms the figure is very high. As long as the U.S. has the economic power to pay back the interest and return the principal for the matured bonds, both the U.S. and China have little to worry about. However, the current talks on debt ceiling and budget talk have changed the atmosphere. For the U.S. when a single country has such high debt in time of financial instability is one more thing to worry about. For China, it is now holding a potential time bomb – even though the chance of the U.S. default is very low, the lessened credibility of the U.S. government bonds means the future investment channel is narrowed. The portfolio of Chinese government requires changes, and the currently-held debt needs to be reevaluated in terms of the possibility of return. Chinese government needs to diversify its risk coming from the U.S. instability.

U.S. government debt holder, accounting for the 8 percent of total U.S. public debt. Even in percentage terms the figure is very high. As long as the U.S. has the economic power to pay back the interest and return the principal for the matured bonds, both the U.S. and China have little to worry about. However, the current talks on debt ceiling and budget talk have changed the atmosphere. For the U.S. when a single country has such high debt in time of financial instability is one more thing to worry about. For China, it is now holding a potential time bomb – even though the chance of the U.S. default is very low, the lessened credibility of the U.S. government bonds means the future investment channel is narrowed. The portfolio of Chinese government requires changes, and the currently-held debt needs to be reevaluated in terms of the possibility of return. Chinese government needs to diversify its risk coming from the U.S. instability.

Geo-Political Movements of China

As China is a well-known politically stable country with one party system, at the moment of the U.S. instability, the characteristic is clearly a benefit to China. However, in modern economy, nations maintain close political and economic relationship. This means the U.S. instability will have a likely negative impact on China.

Then the question we have to ask is how much impact the U.S. instability will have on Chinese economic growth. It is possible that China would not be able to enjoy high growth rates it used to for the next 3 to 4 months, as the U.S. is one of the top 3 markets for China. If the U.S. market is not able to consume as many goods as it used to be due to the instability, China will face further reduced exports. These exports alone represent about one fourth of the total GDP, and the net export is about one eighth of the total GDP. Therefore, if China export to the U.S. slows by a considerable amount because of the instability, the consequence for China will not be great. Whether it was done to counter such consequence is not clear, but the president Xi and the premier Li’s meetings with the leaders of ASEAN nations can be seen as a type of insurance for China. This will not only increase the geo-political strength of China, thus further stabilizing regional politics, but also create more economic ties with the region to divert exports and investment channels.

However, so far the “magnet of economy” is still at the U.S. market, and the power of the magnet is very strong. In other words, the determinant of global market trends is the U.S. and that fact will be the key to the Chinese economic prospects. The geo-political factor of Southeast Asia is not yet strong enough to counterbalance the current instability formed in the U.S. market and politics.

Possible “Next Steps” for China

The Chinese market may not show a sudden change, but the prolonged instability will certainly diminish the economic strength that China has been showing for a couple of decades. This means China has to prepare for certain changes that could affect its future growth. Before the shutdown, there had been worries on the U.S. Federal Reserve’s (the Fed) tapering on quantitative easing. Now the concern on the U.S. budget and debt ceiling talks adds more worries to developing nations. Nations including China will have to worry about whether to focus on development as they have been doing, or to focus on stabilizing the domestic economy and strengthening the weak links within their own economy. As the government shutdown caused economic instability, the Fed will most likely continue its quantitative easing to secure economic conditions for now. That does not mean the instability of the Fed’s tapering is removed, because it is like the status of the U.S. budget talk: the quantitative easing is only a temporary solution.

Even though China has a huge domestic market, in time of economic instability, the driving force of economy is hard to find. Export is not going to help China go through this hard time as the whole world is suffering together, and domestic consumption growth is still up in the air. In September, Chinese exports faced an unexpected year on year drop. When looking at the income of Chinese people, that does not seem to help increase domestic consumption. Other possible economic boosts such as government spending or investment are still viable options, but the question is “how long and how much the Chinese government and corporates are willing to put money into it?”

Not only that, China also faces the question of liberalization of the market. China has shown strong commitment to liberalize and open up further to the global market, especially in financial and trade sectors. The recent interest rate reform and Shanghai Free Trade Zone were two of the examples that have shown Chinese commitment through action. Since there is instability in the global market, the economy will not be as energetic enough as Chinese government expected it to be for its liberalization process. This means that China can cut its effort down to open up the market and slow down the pace of economic expansion. This could be a problem if the investors around the world, who think China will still show strong growth, find out about the policy changes in China. Even if the investors have anticipated the slowdown, the actual impact of Chinese slowdown will be massive, considering the size of Chinese economy.

Also, Chinese government external debt has increased significantly in recent 10 years, more than tripling since 2002. China has funded many projects through debt, and if the economic expansion diminishes, it will adversely affect the debt / deficit balance in China. The Chinese government will have a harder time borrowing money at the same interest rate, and have a harder time paying back debts as the profit from projects diminishes due to the domestic economic slowdown and the global economic recession. Then the government projects will have to face the new consequence of either reduction in size or complete shutdown, and overall investment and financial inflow will diminish, which can be a vicious cycle. Even though Chinese government will put extra effort to prevent such cycle, the diminishing trend is inevitable.

However, It could be a good opportunity for China in terms of restructuring its domestic economic design. Rather than focusing too much on expansion and growth, China can restructure its economy through strengthening small and medium enterprises, or increase the consumers’ purchasing power. The latter might be a harder task for China, as it includes increased welfare, restructuring of wage systems, and implementation of social safe-nets – this is even hard for other developed nations. However, strengthening SMEs is achievable through several banking reforms that would either guide banks to give more access for SMEs to capital, or allow more commercial and private banks to open up and target SMEs as major customers.

China’s Possible Direction

Overall, China is facing a key decision-making period as the U.S. economic power is in question due to the prolonged debt ceiling and budget talks. With strong economic ties to the U.S., China faces trade-offs: whether to continue its economic expansion policies or to restructure its economy. It will be detrimental for China to continue the expansion as there will be no country to be able to support such moves economically. Especially when the world’s number 1 economy is unstable, the scenario is highly unlikely. Hence China will stay low and withhold any further reforms that can tip off the balance. Possible policies could be to strengthen domestic markets, but even then, the implementation of policies will not come fast, as the instability from the U.S. is not predicted beforehand. Nevertheless, this can be the valid option for China at this moment – the restructuring is an inevitable process for a developing nation.