Displaying items by tag: china

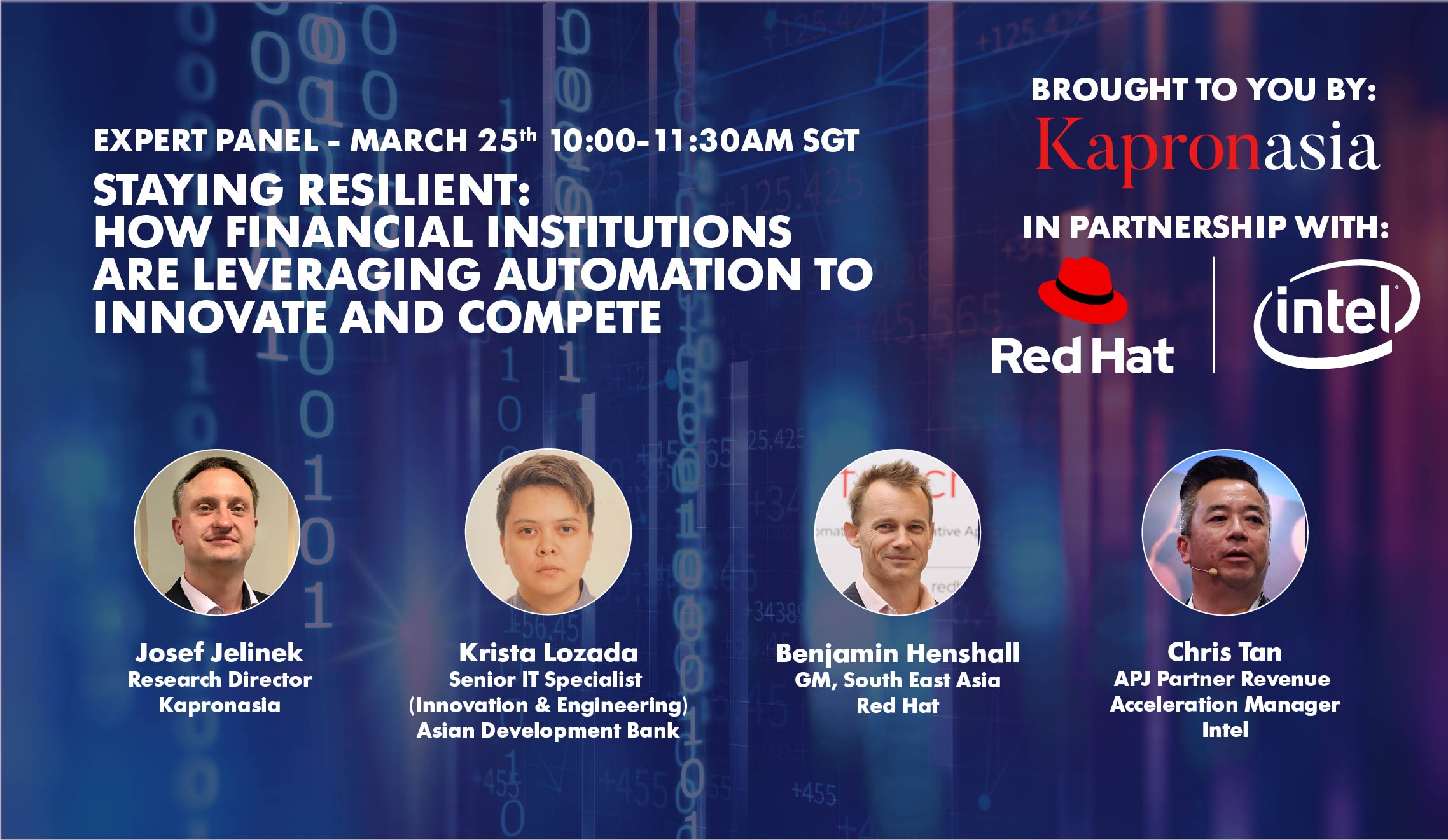

Webinar - Staying Resilient: How Financial Institutions are Leveraging Automation to Innovate and Compete

Finally after all the discussions about China's central bank digital currency, we're getting close to the actual launch as the platform goes into pilot.

Back in 2016, when the European Union (EU) released its General Data Protection Regulation (GDPR), lawmakers from the rest of the world welcomed it as a pioneering model to study and cite. So, when European Commission President Ursula von der Leyen announced in 2019 that her organisation had ambitions to take GDPR-like leadership in regulating Artificial Intelligence (AI), technologists and governance professionals across the globe took note. Ms. von der Leyen stated in a speech before the European Parliament last November, "With the General Data Protection Regulation we set the pattern for the world. We have to do the same with artificial intelligence."

Roughly 100 days later, in February 2020, the EU published the strategy paper, "White Paper on Artificial Intelligence - A European approach to excellence and trust." Disappointingly, an initial reading of the document suggests that regulators in Asia and the rest of the world should not expect GDPR-like leadership from Europe on the responsible use of AI. The authors of the EU white paper were certainly limited by the tight, 100-day deadline that was imposed upon them. Nevertheless, from an AI governance perspective, their report and its proposals seem timid, rather than bold. There is little that compares it to the ambitions that the GDPR showed for protecting data privacy. Consequently, the direction of AI governance may continue to be driven by countries like China, whose 2017 Artificial Intelligence Development Plan (新一代人工智能发展规划) highlighted their focus on quietly influencing international standards.

2020 Top Ten Asia Fintech Trends #4: China's digital payments giants expand across the Belt and Road

The fintech arms of Chinese internet giants Alibaba and Tencent have fought each other to a standstill in their home market. Together, Ant Financial (through its e-wallet Alipay) and WeChat Pay each hold about 90% of China's US$25 trillion mobile payments market, each with roughly an equal share. The duopoly looks stable for now.

2020 Top Ten Asia Fintech Trends #3: Blockchain with Chinese characteristics blossoms

Much like its anti-corruption campaign, China's crypto crackdown is relentless. Beijing views decentralized digital currency as a conduit for money laundering and capital flight. In contrast, Beijing sees crypto's underlying blockchain technology as useful. Blockchain can help China boost its tech prowess, improve supply-chain integrity and surmount bottlenecks across many industries, particularly financial services.

Vanguard to offer retail investment advisory to Chinese consumers through partnership with Ant Financial

Vanguard hopes to break into the China market through its new partnership with Ant Financial. The two giants announced a joint venture on December 16, 2019, a financial roboadvisor service with an initial investment of approximately 20 million yuan (USD$2.86 million). Individuals with a minimum investment of 800 yuan (USD$115) may access the service, where they could build their investment portfolios from over 5,000 mutual funds offered by Ant Financial.

Shanghai’s new NASDAQ STAR exchange – a supernova or just another Made-in-China flashlight?

Can Shanghai’s new NASDAQ-style exchange really become a NASDAQ and can Shanghai become New York?

PingAn Good Doctor: China Healthcare Disrupted

Imagine you are sick at midnight. You lay in the bed comfortably and consult your private doctor through your smart phone at home. They know your medical history perfectly and give you a personalized prescription online. You don’t need to go to the pharmacy. With a few clicks on an app you purchase drugs and they arrive at your doorstep within an hour and everything is seamless. This is not necessarily a futuristic movie, but rather - reality made possible by PingAn Good Doctor - the largest and artificial intelligence powered mobile medical platform in China.