Asia Capital Markets Research

According to the latest numbers from Ministry of Commerce of PRC, in the first 4 months of 2014, the investment into Hong Kong from Mainland and exports from Chinese mainland to Hong Kong decreased largely.

Hong Kong-Shanghai Stock Market Connect

On April 10, 2014, the Chinese government approved the proposal for Hong Kong-Shanghai Stock Market Connect program, which will allow mainland investors to directly trade stocks in Hong Kong market and Hong Kong investors to trade equities in A-share markets.

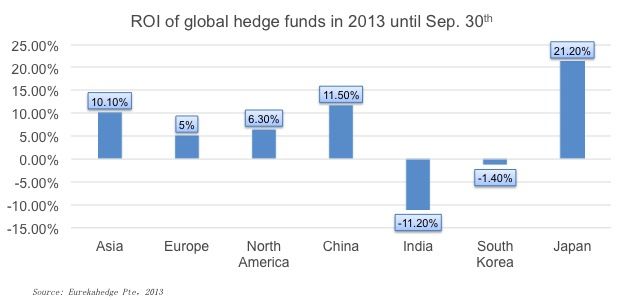

Asian hedge funds lead global ROI for 2013 YTD

Recent figures from Eurekahedge showed that the general ROI of Asian hedge funds (10.1%) surpassed that of North American hedge funds (6.3%) and Europe hedge funds (5%) for the first 3 quarters of 2013. However, among Asian countries, Japanese and Chinese hedge funds have experienced relatively high ROI while Indian and South Korean hedge funds suffered from negative ROI. Market analysts suggested that, the high ROI from China is because of the sustained and relatively fast economic growth, while the high ROI for Japan is for the massive economic stimulation.

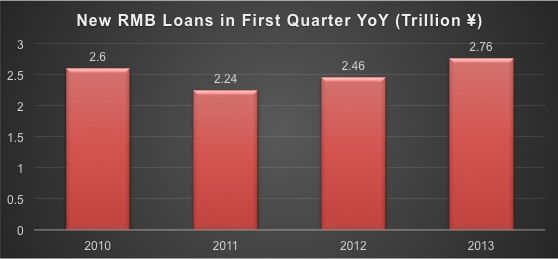

New RMB loans in Q1 2013 reach a 3 year high

According to the PBOC, the value of new RMB loans in the first quarter of 2013 are at a three-year high. In the first quarter of 2013, the new lending is 2.76 trillion yuan, growing by 13%, compared with 2.46 trillion yuan in the same period of 2012. It signals that the financing demands in the market start are increasing and analysts believe the total new loans will reach 9 trillion yuan in 2013. More interestingly, among the newly increased loans, 30% of the loans are long-term loans, showing a sign of a strong economic rebound in China.

A big change for China’s cross-border RMB payment

In order to facilitate the RMB’s cross-border settlement and promote the global use of the RMB, China’s central bank (the PBOC) is now building an international payment system called as CIPS (The China International Payment System). This CIPS is expected to take one or two years to launch and will make cross-border RMB trade settlement more efficient and safer.

RQFLP: a new channel for offshore RMB back to mainland China

Shanghai has been authorized to become the first pilot city for a new RMB cross-border program – RQFLP (Qualified Foreign Limited Partner, RQFLP) which means offshore RMB can be raised and used for private equity investments in the Mainland. Following traditional FDI (Foreign Direct Investment) and RQFII (RMB Qualified Foreign Institutional Investors), RQFLP has become a new channel for the backflow of offshore RMB. Bank of Shanghai and the Hong Kong subsidiary of Haitong Securities (one of biggest securities in mainland China) have signed a memorandum of cooperation to be the first to issue RQFLP products in Hong Kong. The total quota is about 1 billion RMB. Bank of Shanghai will provide custody services and Haitong securities will take charge of the design and issuance of the RQFLP products in Hong Kong. After being raised in Hong Kong, these offshore RMB will enter into Shanghai for private equity investments.

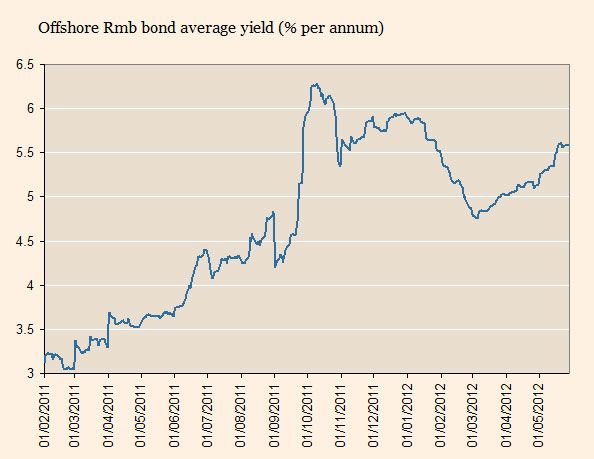

Dimsum bonds no longer appetizing

We have talked about this before, but the latest chart from Reuters / BOC HK is another indication that demand for RMB denominated bonds in HK is waning as yield is creeping up once again. This is creating a bit of a knock-on effect as the cost of financing through RMB bonds rises making traditional USD bonds more attractive. We expect this to continue for the rest of the year actually as there are no near-term events that we are expecting that would change the trajectory or somehow make RMB more attractive.

Decline in HK RMB deposits a sign of things to come?

Earlier this week the Hong Kong Monetary Authority published the December 2011 monetary statistics. Among all of the data, one interesting statistic stood out which was the decline in RMB deposits held in HK also called CNH.

Earlier this week the Hong Kong Monetary Authority published the December 2011 monetary statistics. Among all of the data, one interesting statistic stood out which was the decline in RMB deposits held in HK also called CNH.

We have talked about this trend in previous commentaries, but the relatively sharp decline could be an indicator of what is to come. One of the key reasons for the decline is no doubt the clarification by the Chinese government on the official procedures for bringing offshore RMB back onshore to be used in the onshore RMB or CNY market.

The main official channel, which is just getting off the ground is the reverse QFII program or rQFII, but since the market was setup, there have been certain exceptions that have allowed offshore companies to bring money back onshore especially if the offshore company is a subsidiary of an onshore entity. Bank of China is one of the companies who was able to take advantage of this.

The offshore market still holds some appeal for Chinese corporates who are looking for loans or to raise money, but struggle to do so in the onshore market due to tighter credit conditions. The clearer rules about bringing CNH back onshore however make raising RMB in HK even more attractive.

Yet, we expect that offshore RMB deposits will continue to slow or decline as more companies take advantage of the expanding channels to bring money back onshore and the RMB as a whole becomes less attractive due to the expected slower future appreciation of the currency.

China’s new RQFII program – Enabling Offshore RMB Remittance

On December 16th, the China Securities Regulatory Commission (CSRC), the People's Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) together issued the rules for the RQFII (RMB Qualified Foreign Institutional Investor) program and officially launched the RQFII programs in Hong Kong to enable qualified Hong Kong subsidiaries of fund management companies and securities firms to use their RMB funds raised in Hong Kong to invest in mainland securities.

Maintain stability and control risk

According to the rules, the maximum investment quota of RQFII programs is set at about 20 billion RMB, and at least 80 percent of RMB must be invest in fixed-income securities, while no more than 20 percent can be used for investment in stocks and equity funds. These restrictions on investment quota and portfolio reflect regulators’ concern with the adverse effect caused by excessive investment and their priority to keep the mainland financial market stable and to control risk.

As of April 2011, 16 securities firms and 9 fund management companies had Hong Kong subsidiaries which will be considered ‘qualified’ and included in the RQFII approvals in the future. Up to December 23rd, 9 fund management companies first gained the RQFII approves from CSRC, with their RQFII products launching next February at the soonest.

Impact of the RQFII Program

Compared with the total market capitalization of China’s A Share market and the rules that restrict the amount that can be invested in equities, the initial implementation of the program will likely have little near-term impact on the market. However, the latest statement from Guo Shuqing, the new chairman of the CSRC, clearly indicates that the CSRC is committed to encouraging long-term capital to flow into the stock market. The RQFII programs are another important part of this strategy as they will open another significant channel for overseas RMB funds to flow back into the mainland capital market.

The program will likely have a greater impact on HK markets as overseas RMB funds have to date had limited investment choices. Because of this, there will be quite a bit of demand for the RQFII program and likely the first batch of RQFII products will not meet investors’ demands. The 20 billion RMB investment quota will be increased in the future and the influx of capital through the RQFII will inevitably benefit to Chinese Stock in a long term.

As one of ways in which China make its currency to more international, the RQFII programs, by giving a green light to investment of overseas RMB funds in mainland securities markets, will not only make Chinese capital market more open but also facilitate off-shore RMB business by diversifying investment products for overseas RMB funds.

At first, regulators will tightly control the program as to ensure it does not expand too quickly, however, the authorities will continue to widen the investment channel of overseas RMB funds and making the RMB an international currency slowly will not change.

More...

Selling consumer data - how much is fair?

Without a doubt when we look back at the year in review for 2010, one of the key industry issues of the year will be that of consumer data protection. With numerous breaches at some of the world’s largest banks and credit card institutions, it’s clear that data privacy and protection is still an issue – and one that is back on the front page this week.

China’s Yuan Strategy in the Post-Crisis Era

After over thirty years of opening up and economic reform, in 2010, China officially overtook Japan to become the world’s second largest economy, trailing only the United States. Undoubtedly, the global financial crisis that took hold in late 2008 has served as a turning point for China to rapidly transform itself into a global engine of growth.

Singapore: Bubble? What bubble?

Bridging the Strait

The government of the new Taiwanese President Ma Yingjeou has, over the past few weeks, taken a number of key steps towards financial services liberalization between Taiwan and the mainland that are pointing towards a more integrated financial sector. The two players have always been closely economically intertwined, but there have been many barriers in place that have prevented a more complete integration. Those barriers are now starting to come down.