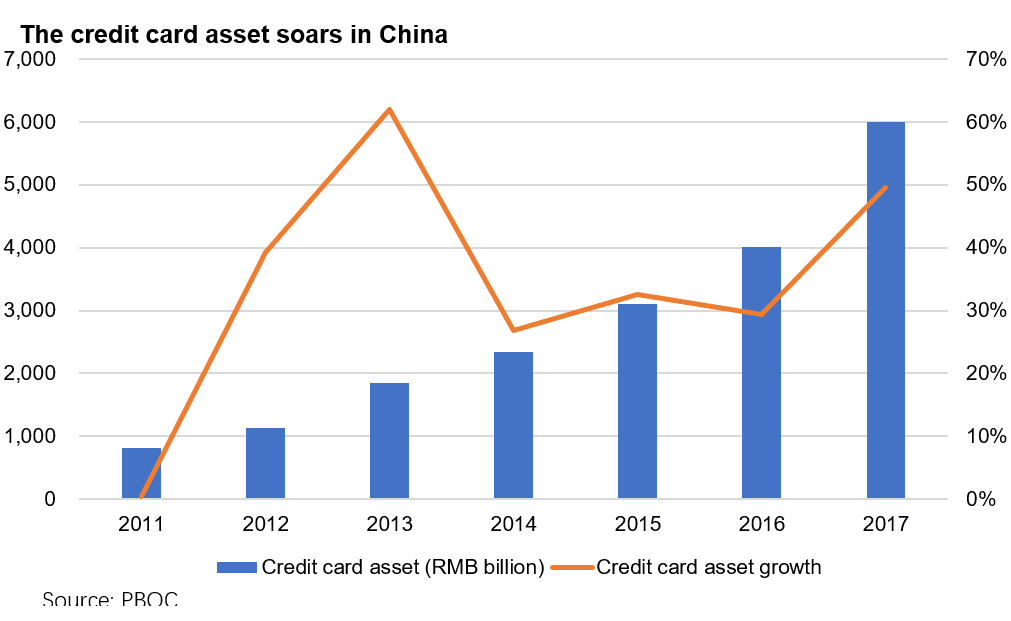

After the Chinese government brought tight control on P2P lending and cash loans, the credit card balance transfer business has attracted a lot of attention recently. Taking advantage of the fast-growing credit card market, it does not come as a surprise for big success within the credit card related services. Another similar example would be 51 Credit Card which is listed in Hong Kong.

The credit card balance transfer is a popular service for credit card users in developed countries. When credit card users cannot pay their debt before it is due, they will have to pay the overdraft rate and extra penalties with a total cost that can be over 25% APR. Because the cost is so high, companies have started providing short term lending with better interest rates and helping the consumers manage their credit card debt. As consumers pay less interest rate or penalties, a balance transfer service can increase their willingness to repay the debt. At the same time, with better management of their credit cards, these platforms improve the customers’ liquidity level, which can lead to more consumption in the future.

Among many similar players in the credit card management industry, Samoyed stands out due to its low fee strategy. The management team at Samoyed has a solid background in the credit card industry in China. Samoyed chose to attract as many users as possible before making profits. The low fee strategy and other promotions had a great impact on the market and they have accumulated 24.4 million users in China by June 2018. Also, the good customer experience makes their customers keep coming back. However, the price to pay for such growth is over three years loss and Samoyed just started to make profits this year. But it seems all worth it.

Samoyed’s success also relies on its good risk control. First of all, is it risky to lend to credit card users who cannot pay back in time? Not necessarily. These customers are already credit card holders. As a starting point, it is less risky than lending money to strangers in the street. In another word, banks have already done the first risk control process for these platforms. Also, by lending to millennials group, Samoyed achieved even lower default rate than banks.

Look into the future, when the credit card industry is still booming, companies like Samoyed probably will do well in the next few years. However, they have to keep their focus and a low default rate. That is the key to compete with more competitors coming into this market. Another challenge may be from the Chinese government. When the market reaches saturation, the risk level will increase. There will be more regulations issued from the top. However, there are more opportunities within the credit card market. After creating a sizeable customer base, companies can provide more services along the line, which means more future growth.